VAT Registration for ‘New Companies’ in UAE

UAE is a paradise of business opportunities. The leaders of this country are giving utmost priority to support new businesses in the country. There are a lot of Government initiatives to attract entrepreneur’s & giving all the requirements to sustain their business in this country.

Since VAT is implemented in UAE, new companies are in confusion weather they need to register for VAT or not. Here, we will help you to clear all your confusions regarding your VAT Registration of newly setup business in UAE.

1, Why I need VAT Registration for my new business in UAE?

You will be thinking whether, “I need VAT registration in UAE”, since it’s a newly setup business.

Yes, there are a lot of reasons to do the VAT Registration for your new business in UAE.

- Federal TAX Authority have fixed certain turnover limits to register for VAT. If you surpassed that threshold, it is mandatory to register for VAT, If not, you will be penalized for not doing VAT Registration in UAE on time.

- Failure to provide TAX Registration number, will affect the reputation of the business. Especially, if you are doing a B2B business, certain suppliers & customers will hesitate to do business with you, if you didn’t provide VAT Registration Number.

2, When I need to do VAT Registration?

A business operating in UAE is obliged to do VAT registration, if it surpassed certain Turnover criteria mentioned below.

Criteria for VAT Registration In UAE.

As UAE Federal Government introduced Value Added Tax (VAT) in UAE on 1 January 2018, businesses come under following criteria are supposed to register for VAT.

- VAT Registration is mandatory, if businesses taxable supplies and imports exceeds AED 375,000 per annum.

- VAT Registration is optional; whose supplies and imports exceed AED 187,500 per annum.

3, How To do VAT Registration?

VAT Registration in UAE can be done through the eService’s portal of Federal Tax Authority. However, to start the process, they need to create an account first. After creating the account, user need to login to the FTA eService’s portal & need to submit all the legal & financial documents required for TRN Validation.

Our experienced team of VAT Consultants can guide you through all the process.

You can access FTA e-Services portal by clicking below mentioned link.

https://eservices.tax.gov.ae

If you still finding difficulties in VAT registration, you can contact our Tax Consultant in UAE, Mr. Anderson (+971 54 5881515)

4, How to calculate VAT for your business?

VAT is a tax on the transactions of goods and services, it is applied at each stage of the supply chain and is based on the value added at each stage. There are three parties involved in every business, Supplier, Business Firm & Customer.

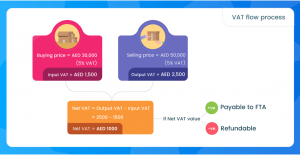

Input VAT — VAT paid to the suppliers of the business firm is known as input VAT

Output VAT — VAT collected from the customers of the business firm is known as output VAT.

By knowing your input VAT & Output VAT, you can easily calculate your VAT due to FTA.

VAT Due = Output VAT – Input VAT