VAT Registration UAE

How to Apply for VAT Registration in UAE?

Complete Guide for FTA VAT Registration Requirements and process.

VAT Registration UAE

VAT registration in the UAE often faces challenges due to inadequate documentation, such as missing sales orders, sales invoices, purchase orders, or purchase invoices. To ensure compliance and show administrative authority, proper paperwork is essential. Since its introduction, the need that companies with an annual turnover of AED 375,000 or more register for VAT has received strong support from both residents and business experts, highlighting how crucial it is to comply with this legal duty. A seamless VAT registration process and the avoidance of fines depend on precise and comprehensive documentation.

To get registered with the Federal Tax Authority, an individual, or a corporation must complete a sequence of steps throughout the VAT Registration process in the UAE. (FTA VAT Registration). Our expert Tax Agent in UAE have received specialized training and have been assigned to simplify the process and provide advice on adhering to all legal norms and regulations.

Our seasoned team of specialists, known for their success, will begin by covering the fundamentals of VAT standards and will use their knowledge to provide thorough support throughout the VAT Tax Advisory Services.

Types of VAT Registration UAE

There are two types of VAT Registration UAE:

1. Mandatory VAT Registration

This Mandatory VAT Registration is the type of Value Added Tax in which the businesses have to register mandatorily. The Total value of its taxable supplies and imports exceeds the threshold over the previous 12 months.

2. Voluntary VAT Registration

Businesses who didn’t meet the criteria of Mandatory VAT registration apply for voluntary VAT registration. The businesses exceed the total value of its taxable supplies and imports in the previous 12 months threshold.

VAT Registration Services in Dubai, UAE

VAT Registration UAE

Our highly educated team of tax professionals will assist you in establishing a business in the UAE by offering expert advice on any tax concerns that may arise. Our clients receive highly specialized and effective VAT Registration Services in Dubai and assistance across all UAE Emirates.

Accounting Services

Proper bookkeeping, invoicing, and document management are critical for a successful entrepreneurship. Our clients receive highly specialized and effective VAT registration guidance and assistance across all UAE Emirates.

UAE Free Zone Businesses

Keeping correct financial records may allow you to make more informed business decisions. Audit reports will be created in accordance with the parameters provided by the clients. This is applicable to organizations in UAE free zones such as RAK free zone, JAFZA, DAFZA, DMCC, and others. Our services include audit reports for business license renewal, business closure, and bank account opening.

Audit & Assurance

Services

Our audit and assurance services are available to firms of all sizes and industries in the UAE, whether they are headquartered in one of the free zones such as JAFZA, DMAZ, JLT, DMCC, DSO, RAK Free Zone, UAQ Free Zone, or SAIF ZONE

Management Consultancy Services

Our specialized consulting services are designed to assist businesses with free zone company creation, setup procedures, PRO services, bank account establishing, marketing tactics, and so on, while delivering customized solution packages for each particular situation. Within the time frame and parameters specified.

Corporate Finance

Services

The special finance unit will be in charge of managing the distribution of capital structure among all enterprises. The procedure necessitates keeping an eye on management’s expenditures and operations, as well as evaluating the tactics and evaluations used to emphasize the distribution of financial assets in order to optimize the business’s success.

Why Choose Us?

VAT Consultancy Services in UAE

With a wealth of experience in various industries, our dedicated team of professionals tackle each task with well-informed perspectives which combine proven skill, intuition and practical creativity.

Best Vat Filing in UAE

We offer expert assistance, ensuring timely submissions and accurate calculations while maintaining compliance with regulations through our user-friendly software.

Best Industry Knowledge

Customized Solutions

Each customer and industry has their exclusive characteristics. We specialize in offering customized solutions that meet your present and future organization requirements as part of our VAT Consulting Services in Dubai.

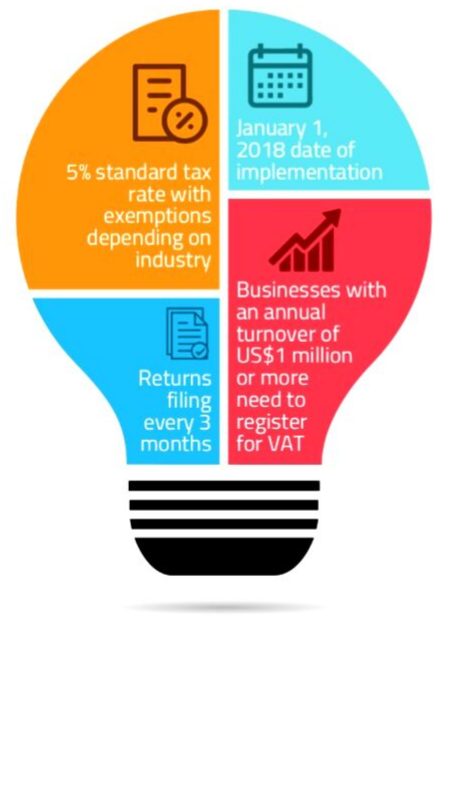

UAE VAT Registration Implemented

On the first day of 2018, the UAE introduced the implementation of Value Added Tax. The Federal Tax Authority (FTA) imposes a 5% value-added tax on all products and services sold in the UAE. As a result of VAT being an indirect form of taxation, the ultimate burden falls upon the user at the end of the supply chain. The companies collect the VAT on behalf of the government whenever they engage in a sale.

The VAT registration in the UAE is stipulated by the UAE. Any business that fulfils the criteria will need to enrol for VAT since the UAE Federal Government has established Value Added Tax (VAT) in the UAE on January 1st, 2018.

Annual taxable imports and supplies worth AED 375,000 or more require businesses to register for VAT Registration Dubai.

How to Register as a VAT Entity in the UAE?

In the UAE, registering as a VAT entity is simple. First, determine your eligibility by looking at your company’s annual turnover. It is required for companies that make more than AED 375,000 and optional for those that make more than AED 187,500. Then, collect the necessary paperwork, such as your financial records, Emirates ID, and trade licence. On the Federal Tax Authority (FTA) portal, create an e-Services account and fill out the VAT registration form with the proper data. Submit the form with supporting documents. You will be issued a Tax Registration Number (TRN) upon approval. Charge VAT, send invoices, file returns, and keep records following FTA regulations to guarantee compliance.

10 Documents Required For VAT Registration in UAE

- 1. A copy of the company’s trading license.

- 2. A certificate of incorporation or registration, if required.

- 3. Any other document that offers information about the organization to management, such as the memorandum of association, articles of incorporation, partnership agreement, or bylaws.

- 4. A copy of the manager’s Emirates identification card and passport

- 5. Information on the signatories.

- 6. The physical location of the company’s headquarters.

- 7. Contact details for the company.

- 8. Details on the company’s bank account.

- 9. A list of prior partners and other commercial relationships in the UAE, as well as copies of their trade licenses.

- 10. Declaration from business house regarding: a) Details of applicant’s business activities; b) Estimation of financial transaction values; c) Details of applicant’s last 12 months’ turnover with supporting

Common Mistakes in VAT Registration in UAE

Mistakes during VAT registration UAE can lead to penalties and delays. Miscalculating turnover frequently leads to inaccurate eligibility evaluations. Incomplete or inaccurate submission of required documents, such as trade licenses and financial records, is another frequent issue. Making incorrect company decisions or not appropriately disclosing taxable suppliers can make things more difficult. Additionally, many enterprises fail to register by the deadline, which results in penalties from the Federal Tax Authority (FTA). Make sure all paperwork is exact, deadlines are met, and all information is complete to prevent these errors. Simplifying the procedure and guaranteeing compliance can be achieved with expert assistance.

VAT Registration in Dubai, UAE

Industry professionals will assist you with VAT Registration in Dubai by registering your company with the FTA and obtaining your Tax Registration Number. (TRN). The UAE Federal Government imposed Value Added Tax (VAT) on January 1, 2018. Every business must register for VAT if its taxable supplies and imports exceed AED 375,000 per year; registration is optional for enterprises with supplies and imports surpassing AED 187,500 per year. We help you obtain a TRN number and streamline your process. Operations.

6 Tips for registering for VAT in UAE

Latest Updates on VAT Registration UAE

Free Zone, as well known as Free Exchange Zone, is an district laid out to advancement the around the world…

A Doled out Zone is an locale which is demonstrated by the cabinet choice which meets the conditions supported…

For supply of organizations, the way of choosing the time of supply is comparable to that for choosing the time of supply…

The Government Survey Pro (FTA VAT) of UAE has announced three unused VAT free zones which are known…