vat regisration service dubai

vat regisration online dubai

vat return filing service in dubai

vat registration consultant in dubai

vat implementation service in dubai

vat consultancy services dubai

vat de-regisration service dubai

We offer reliable VAT registration services in dubai. You can register for VAT online by following our instructions. we give best service for vat de-regisration, vat consultancy, vat implementation, vat return filing, vat regisration online, vat regisration service.

vat de-regisration service dubai vat consultancy services dubai vat implementation service in dubai vat return filing service in dubai vat regisration online dubai vat regisration service dubaiVAT Registration Dubai

Value Added Tax (VAT) was implemented in Abu Dhabi, United Arab Emirates, on January 1. It is Important to do VAT Registration Dubai in Abu Dhabi, United Arab Emirates, the Federal Tax Authority (FTA) levied a Value Added Tax (VAT) of 5% on all goods and services. Because VAT is an indirect tax, it is ultimately the responsibility of end consumers to pay it. Every time a sale is made, the business pays the government’s VAT.

The standards established by the UAE for VAT registration Dubai. Value Added Tax (VAT) was implemented by the UAE Federal Government on January1 of this year, covering all seven emirates: Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaima, and Fujairah. companies that meet the criteria. As the Tax Consultants in Dubai, we provide all type of VAT Services Dubai. Our Tax Consulting Firms in Dubai has experienced team of VAT Advisors and Consultants.

vat regisration service dubai

vat regisration online dubai

vat return filing service in dubai

vat registration consultant in dubai

vat implementation service in dubai

vat consultancy services dubai

vat de-regisration service dubai

We offer reliable VAT registration services in dubai. You can register for VAT online by following our instructions. we give best service for vat de-regisration, vat consultancy, vat implementation, vat return filing, vat regisration online, vat regisration service.

vat de-regisration service dubai vat consultancy services dubai vat implementation service in dubai vat return filing service in dubai vat regisration online dubai vat regisration service dubaiHow VAT Services Dubai Help You To Grow Business in UAE?

VAT is not the additional burden or the cost of the business. Normally, the business acts as a bridge for the government. However, the effect is reflected in cash flow. So, the proper planning and the proper management of tax collection and execution gives added value and cash inflow to all the businesses. The VAT Services Dubai helps:

- To avoid errors in filing the tax return

- To claim the paid input tax according to the law

- Offer the guidelines to prevent fines and penalties

- To keep the book of account for the five years according to the law

- To safeguard the company from material/asset misstatement, perform a tax audit

- Get updated or trained related to the latest updates as per the VAT law and its impact on accounting

- Offer the guidelines for the preparation of statements for sales.

Documents Required For VAT Registration Dubai

1. The license that permits a company to conduct business at a specific location.

2. A certificate of incorporation or registration will be provided if it is required.

3. Other types of paperwork that offer management insights into the business, including the articles of association, memorandum of association, bylaws, or partnership agreement.

4. A duplicate of the manager’s Emirates ID and passport.

5. Signer details.

6. The actual location of the company’s office.

7. Contact details of the company.

8. Details pertaining to the bank account of the organization.

9. Provide records of trade licenses of partners and business links in the UAE from the last half-decade.

The business establishment needs to provide a statement concerning the particulars of the candidate.

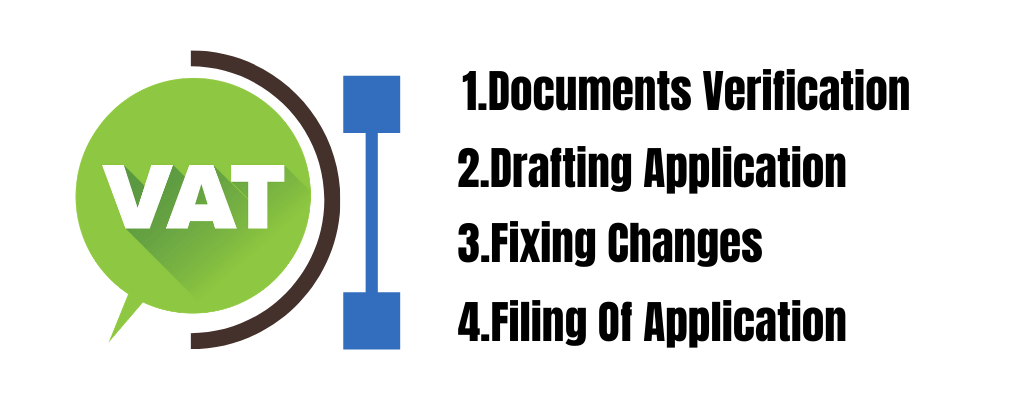

Process For Vat Registration In Dubai

Supplies Not Qualified for Input Charge Recuperation underneath VAT in UAE

Underneath VAT in UAE, enrolled businesses are qualified to recoup...

Read MoreHow to Choose Time of Supply for Organizations

For supply of organizations, the way of choosing the time...

Read More