In the previous article, we learned about tax agents, the conditions for registering as a tax agent, and the duties that a tax agent must fulfill. This article explains the process you need to follow to register as a tax agent under her VAT in the UAE.

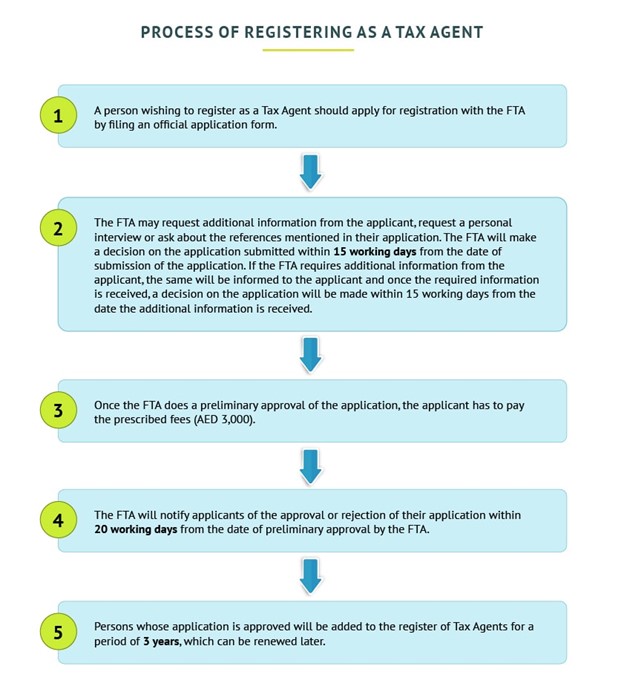

Process for Registration as a Tax Agent

When can my authorization as a tax agent be revoked?

The authorization of a registered tax agent may be revoked in the following circumstances:

FTA determines that the tax agent is ineligible according to the requirements described in the previous article.

The duties of a tax agent affect the integrity of the tax system of the tax agent.

A tax agent committed a serious violation of tax law.

If the registration of a tax agent is canceled, the FTA will notify the tax agent of this decision in a timely manner. It has been 5 working days since his registration was cancelled.

Therefore, the role of a tax agent with respect to her VAT in the UAE is very important. A tax agent acts as an intermediary between the FTA and the taxpayer. For those who register as tax agents, this is a job that carries great honor and responsibility. For taxpayers, appointing a tax agent can help facilitate VAT compliance. Tax advisors can help reduce time spent on compliance activities and reduce compliance errors. Tax agents can also represent taxpayers regarding compliance issues. Therefore, individuals interested in becoming a tax agent under UAE VAT can follow the above process to become a registered and licensed tax agent.

You can also register for VAT Registration on our website: